Internship Opportunities: Now open for international candidates:

1- Econometrics & Operations Research

2- Quantitative Modeling for Algorithmic Trading & Testing

We are looking for candidates for our fast growing work in our knowledge engineering developments in algorithmic trading.

Ad1-

Background of candidate is in Econometrics & Operations Research at a M.A. level university.

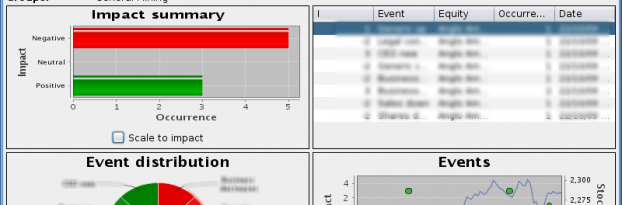

The candidate will be joining our Research & Development team in The Netherlands, near Amsterdam Airport. The thesis project is focusing on news analytics for multi asset class investments. The candidates should have an understanding of the implications and effects from news events on investments and risks. Macro economics and fixed income as well as equities and derivatives are subjects of interest of the internship work.

Duration: 6 month. After a successful completion of the thesis it is expected to be part of the growing development team.

Ad2-

Background of the candidate is in Quantitative Modeling and/or Financial Mathematics (M.Sc./PhD-thesis)

The candidate will be joining our Research & Development team in The Netherlands, near Amsterdam Airport. The thesis project is focusing on news analytics and market data for equity asset class algorithmic trading.

Candidates should have an understanding of risk/(multi) asset valuation modeling and an emphasis on financial service applications.

We require academic experience in the field of financial data analysis and research, with strong analytic solving skills, including tools like Matlab/R and experience of working with statistics and data sets for testing your algorithm and benchmark against indices.

Communication in English is essential to both of the intern positions as well as a valid EU working permit.

If you are interested in any of these positions please send your C.V. to stalknecht@semlab.nl

Read more

Read more